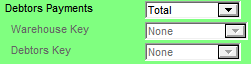

The Debtors Payments group of fields on the Config GL Interface screen allows you to customise the integration of debtor (customer) payments to the General Ledger. This allows for multiple Bank accounts or Trade Debtor control accounts within the Balance Sheet of the General Ledger.

To complete the Debtors Payments fields:

Refer to "Edit - General Ledger Config - Distribution Interface".

Micronet displays the Debtors Payments fields.

Select an integration option:

|

Option |

Description |

|

Total |

The Distribution system searches for a GL interface record labelled TOTAL and produces accounting entries (financial transactions) based on the GL accounts entered in that table. This is the standard, multi-purpose GL interface record setup to accumulate financial transactions where customisation is not required. |

|

Combination |

Ungreys the fields below (Warehouse Key and Debtors Key) allowing you to select exactly how you want debtors payment transactions dissected. This allows data to be transferred from the Distribution system based on the interrelations between the files that comprise your permanent records. For an example of how the Combination option works, refer to "Configuring MDS Integration". |

Where a Bank account or Trade Debtor control account needs to exist for each warehouse, debtor payments can be dissected and transferred to the General Ledger in this format.

Warehouses can be dissected and reported in one of the following ways:

|

Option |

Description |

GL Interface |

Master file update |

|

None |

No dissection by warehouse |

-- |

-- |

|

Warehouse |

During the entry of debtor payments, Micronet asks users to assign a warehouse to the transaction. Accounting journal entries (financial transactions) are raised based on the GL interface record assigned to the relevant warehouse. |

GL interface records need to be setup and assigned to each warehouse record |

Warehouse master file - GL Interface field (refer to "File - Warehouse - Warehouse") |

Debtors Key

Debtor payments can be divided into various GL accounts in the General Ledger based on customer classifications. This ensures that when diverse bank accounts are in operation, customer receipts can be forwarded to diverse GL accounts, ensuring that transactions relating to the reconciliation of various bank accounts update to the correct GL accounts.

This type of configuration can be used where you need to distinguish between local and overseas customers. An overseas bank account may be in operation and payments may be receipted in foreign currencies. These transactions may need to be accounted for separately. Assigning GL interface records to each debtor record is a method of directing customer payments to a specific bank account.

Where there are multiple Trade Debtor control accounts, it also ensures that receipts reduce the relevant control account.

Debtors can be dissected and reported in one of the following ways:

|

Option |

Description |

GL Interface |

Master file update |

|

None |

No dissection by debtor |

-- |

-- |

|

Debtor |

As each payment is entered and allocated to a customer's account, Micronet directs the payment to the specified Bank account or Trade Debtors control account based on integration specifications assigned to the individual customer. |

GL interface records need to be setup and assigned to individual debtor (customer) records |

Debtor master file - GL Interface field (refer to "File - Debtor - Debtor") |

|

Sales Territory |

As each payment is entered and allocated to a customer's account, Micronet identifies the sales territory assigned to the customer and dissects the transaction to the appropriate Bank or Trade Debtors account in the General Ledger. |

GL interface records need to be setup and assigned to sales territory records |

Sales Territory master file - GL Interface field (refer to "Adding a New Sales Territory") |